Traders tend to overcomplicate things when they’re starting out in this exciting market. This fact is unfortunate but undeniably true. Traders often feel that a complex trading strategy with many moving parts must be better when they should focus on keeping things as simple as possible.

The Benefits of a Simple Strategy

As a trader progresses through the years, they often come to the revelation that the system with the highest level of simplicity is often best. Trading with a simple strategy allows for quick reactions and less stress. If you’re just getting started, you should seek the most effective and simple strategies for identifying trades and stick with that approach. Also, new traders would be served well by finding the common traits of FXCM’s successful Traders here.

One way to simplify your trading is through a trading plan that includes chart indicators and a few rules as to how you should use those indicators. In keeping with the idea that simple is best, there are four easy indicators you should become familiar with using one or two at a time to identify trading entry and exit points. Once you are trading a live account a simple plan with simple rules will be your best ally.

The Tools at Your Service for Different Market Environments

Because there are many fundamental factors when determining the value of a currency relative to another currency, many traders opt to look at the charts as a simplified way to identify trading opportunities. When looking at the charts, you’ll notice two common market environments. The two environments are either ranging markets with a strong level of support and resistance, or floor and ceiling that price isn’t breaking through or a trending market where price is steadily moving higher or lower.

Using Technical Analysis allows you as a trader to identify range bound or trending environments and then find higher probability entries or exits based on their readings. Reading the indicators is as simple as putting them on the chart. Knowing how to use any one or more of the four indicators like the Moving Average, Relative Strength Index (RSI), Slow Stochastic, and Moving Average Convergence & Divergence (MACD) will provide a simple method to identify trading opportunities.

Trading With Moving Averages

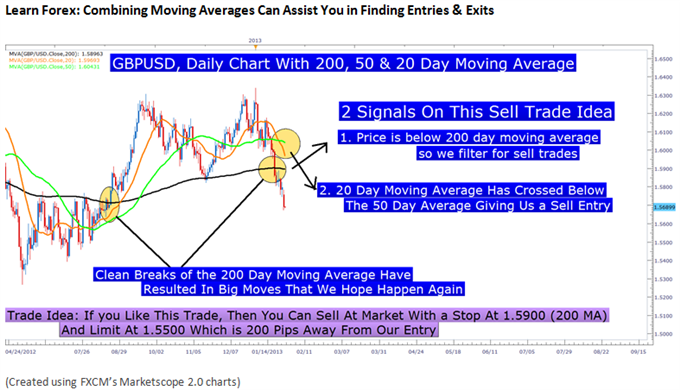

Moving averages make it easier for traders to locate trading opportunities in the direction of the overall trend. When the market is trending up, you can use the moving average or multiple moving averages to identify the trend and the right time to buy or sell. The moving average is a plotted line that simply measures the average price of a currency pair over a specific period of time, like the last 200 days or year of price action to understand the overall direction.

You’ll notice a trade idea was generated above only with adding a few moving averages to the chart. Identifying trade opportunities with moving averages allows you see and trade off of momentum by entering when the currency pair moves in the direction of the moving average, and exiting when it begins to move opposite.

Trading With RSI

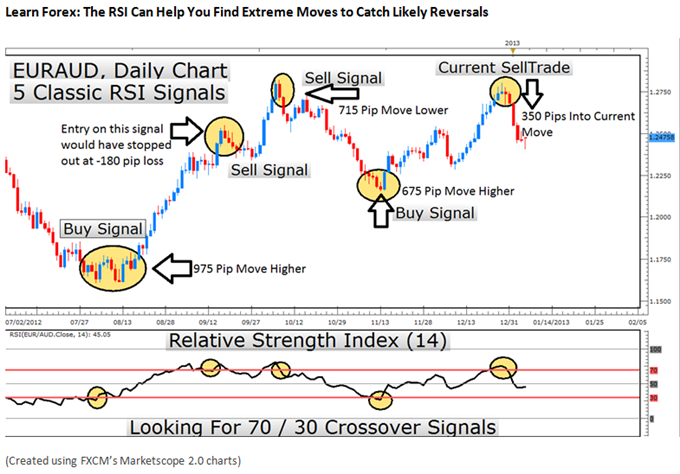

The Relative Strength Index or RSI is an oscillator that is simple and helpful in its application. Oscillators like the RSI help you determine when a currency is overbought or oversold, so a reversal is likely. For those who like to ‘buy low and sell high’, the RSI may be the right indicator for you.

The RSI can be used equally well in trending or ranging markets to locate better entry and exit prices. When markets have no clear direction and are ranging, you can take either buy or sell signals like you see above. When markets are trending, you only want to enter in the direction of the trend when the indicator is recovering from extremes (highlighted above).

Because the RSI is an oscillator, it is plotted with values between 0 and 100. The value of 100 is considered overbought and a reversal to the downside is likely whereas the value of 0 is considered oversold and a reversal to the upside is commonplace. If an uptrend has been discovered, you would want to identify the RSI reversing from readings below 30 or oversold before entering back in the direction of the trend.

Trading With Stochastics

Slow Stochastics are an oscillator like the RSI that can help you locate overbought or oversold environments, likely making a reversal in price. The unique aspect of the stochastic indicator is the two lines, %K and %D line to signal our entry. Because the oscillator has the same overbought or oversold readings, you simply look for the %K line to cross above the %D line through the 20 level to identify a solid buy signal in the direction of the trend.

Trading With the Moving Average Convergence & Divergence (MACD)

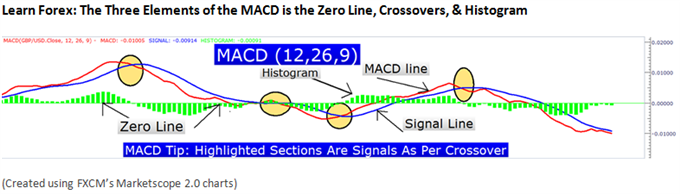

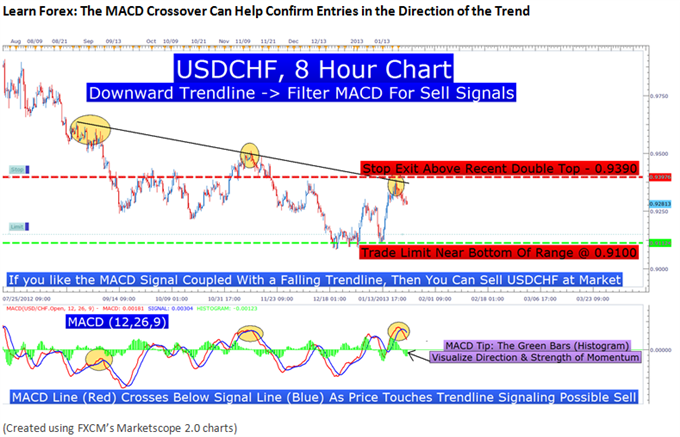

Sometimes known as the king of oscillators, the MACD can be used well in trending or ranging markets due to its use of moving averages provide a visual display of changes in momentum. After you’ve identified the market environment as either ranging or trading, there are two things you want to look for to derive signals from this indictor. First, you want to recognize the lines in relation to the zero line which identify an upward or downward bias of the currency pair. Second, you want to identify a crossover or cross under of the MACD line (Red) to the Signal line (Blue) for a buy or sell trade, respectively.

Like all indicators, the MACD is best coupled with an identified trend or range-bound market. Once you’ve identified the trend, it is best to take crossovers of the MACD line in the direction of the trend. When you’ve entered the trade, you can set stops below the recent price extreme before the crossover, and set a trade limit at twice the amount you’re risking.

Priceless and Free Reinforcement Training

Now that you have the knowledge of the four effective indicators, you are many steps closer to closing profitable trades. Of course, there is only opportunity and no guarantee. To help you spot daily opportunities, DailyFX has created a 4-week no-cost course via their twitter feed, @DailyFXEDU. In a few minutes a day you can follow @DailyFXEDU to see daily opportunities that align with the indicators presented today.

Of course, it’s FREE to follow and designed to be very easy to understand. If you’re building up your knowledge of trading Forex, we want to be there to assist you and your strategy development. Because the only limit to your success is your knowledge, we hope to see you there

https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2013/02/08/Four_Highly_Effective_Trading_Indicators_Every_Trader_Should_Know.html

https://www.dailyfx.com/forex/education/trading_tips/post_of_the_day/2013/02/08/Four_Highly_Effective_Trading_Indicators_Every_Trader_Should_Know.html